Home// Articles// Fundraising// A Founder’s Guide to Data-Driven Budgeting in Biotech

A Founder’s Guide to Data-Driven Budgeting in Biotech

Luciano Santollani

Venture Associate at Pillar VC

Luciano Santollani

Venture Associate at Pillar VC

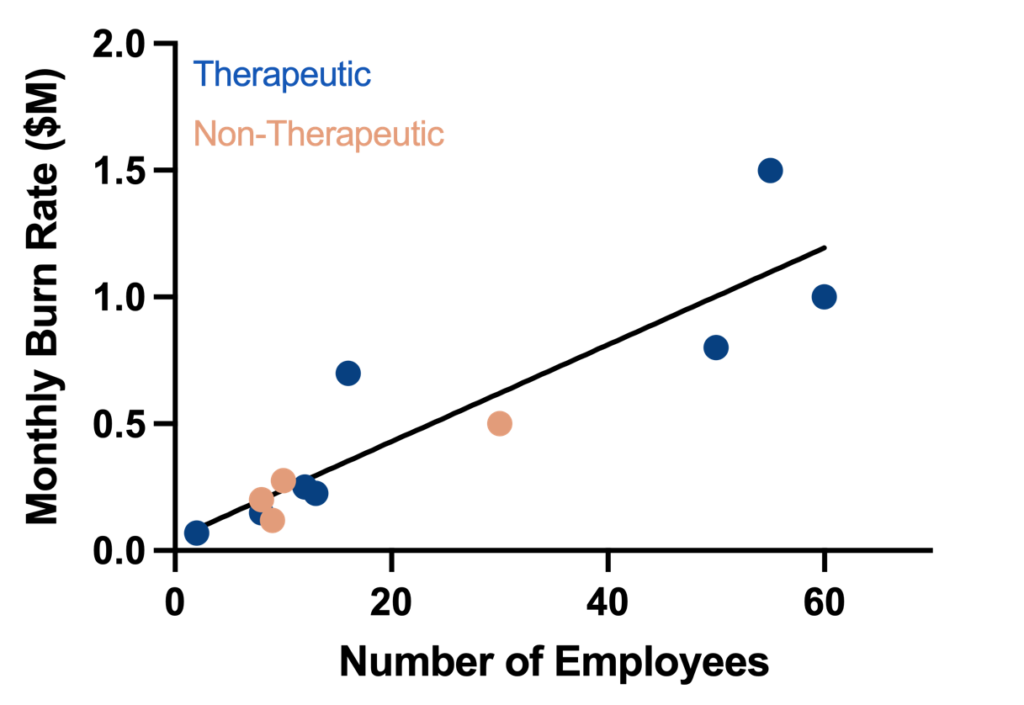

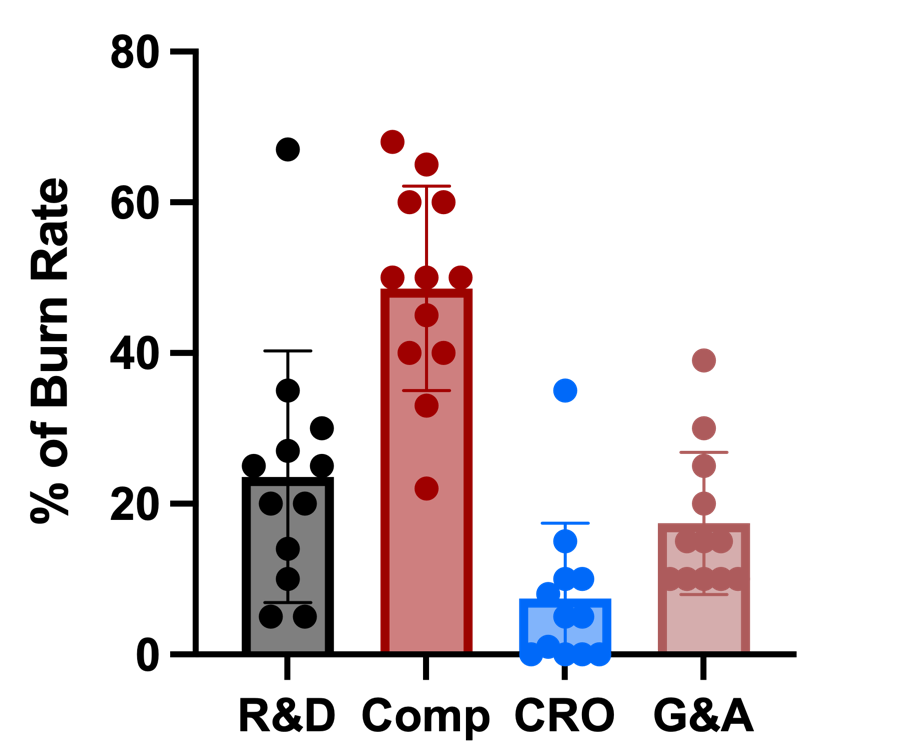

We often get the same question from aspiring founders — how much does it cost to run a biotech startup? From knowing the price of renting lab space to building competitive compensation packages, it can be hard to find data on early stage biotech costs. We set out to create a crowd-sourced resource that provides aggregate cost statistics on R&D spending, compensation, outsourcing, and G&A. We surveyed a dozen founder led-biotechs ranging in size from 2 to 60 employees across various applications — therapeutics, tools, sustainability — to find the answers to some key questions:

How much money should I raise?

Of course, there isn’t a number that will work for everyone, and this may vary whether you are primarily a therapeutics company, where costs are driven by preclinical work, or a manufacturing company, where equipment may be your main cost driver. However, we found average burn rate for an early stage biotech is around $20k/employee/month:

For example, if you think you need 10 scientists and 1.5 years to validate your platform, you would be looking to raise around $3.6M. You may choose to buffer this number by 10-15%.

This is just one metric for guiding your fundraising. Make sure to contextualize and validate this number: 1) does this seem like enough to reach an inflection point in value (e.g. in vivo validation for a therapeutics company)?, 2) is this number representative of other deals being done in the current early-stage biotech fundraising market?, and 3) if I budget very granularly — by calculating the costs of all consumables, salaries, etc — do I get a similar number?

How much should I budget for R&D?

Don’t worry if this figure is higher at the beginning — your capex costs may be front-loaded as you buy necessary equipment to get started. Even though there are some unavoidable big purchases, you can strategize to make these decisions as cost-effective as possible. Some hacks for lowering equipment costs:

- Look for used equipment. There are companies specializing in refurbishing and selling used lab equipment (e.g. LabWorld Group is a solid choice). Ebay also came up as a popular option when talking with founders.

- Become part of larger biotech organizations like MassBio or the Biotechnology Innovation Organization (BIO). These organization will pool their members’ individual purchasing power to unlock savings on equipment and consumable orders.

- Rely on your network. Other start-ups may be selling equipment. Even university labs may be looking to off-load old, but functional equipment.

- Be creative. Equipment manufacturers often charge outrageous prices for simple tools like a water bath. One founder realized that a sous vide — about 1/2 or 1/3 the price of a ThermoFisher water bath — works just as well at maintaining a constant temperature!

- Buy your equipment at the end of the year, if you can. A lot of sales reps will give discounts to meet end-of-year quotas.

- This isn’t necessarily a hack, but look into financing or leasing equipment. Some founders prefer to turn the upfront expense into a monthly cost.

How much should I budget to build a Scientific Advisory Board (SAB)?

There are some good resources out there on how to build an SAB (one of Bruce Booth’s early LifeSciVC posts does a great job on this), but here are a couple of points:

- Build a balanced SAB. Having academic “celebrities” on your SAB can lend credibility to your company, but this will come with a steep price tag and they may not have the time to effectively advise you. Always keep the purpose of an SAB — advising your scientific path — as your north star while you build out the team.

- Be open to different compensation deals depending on the advisory role. Some advisors will prefer all-equity compensation, while others may also charge an hourly rate. If you are meeting an advisor one-on-one monthly or quarterly, they will be on the upper end of the suggested equity compensation. If you’re building a large SAB that only meets once or twice per year, consider closer to 0.1% per advisor

How much does it cost to attract top talent?

For many early-stage founders, the first major financial decision they’ll encounter is a key senior hire. As a young, technical founder, you may have to bring an experienced biotech veteran onboard to help lead a certain team (e.g. preclinical). These hires will often be significantly more expensive, salary- and equity-wise, but will help take your platform to the next level.

Competitive compensation packages are also critical in building a top-notch scientific team. To help benchmark your offers, we’ve found Option Impact to be a great free resource with lots of biotech-specific data. The majority of the founders we talked to offered packages in line with those numbers. As a guideline, we found that for PhD-level scientists at therapeutics companies, compensation was between $100-120k and 0.1-0.3% equity. For a senior hire at these companies, like VP of Preclinical or Manufacturing, most offers were starting around $200k and 1% equity (see Appendix for more).

How do I know what to out-source vs keep in-house?

Almost all of the founders we talked to felt that building out their science internally was the way to go. This will speed up the timescale of iteration and ensure consistency in your experiments. This doesn’t mean that everything needs to happen under one roof. Most therapeutic companies will rent space at a vivarium to do their in vivo work.

If you do choose to use CROs, know that it will be expensive. It can be hard to find true numbers, but Celina Halioua from Loyal does a great job of getting ballpark costs out there in a recent blog post. It’s worth reading the full post, but for reference, even developing an ELISA through a CRO will cost you upwards of $25k. In some cases, CROs make sense, but most founders that work with them agree that it can be hard to find one that you trust and is a good fit for your company’s work.

What else will I have to spend money on?

As your company grows, real estate is going to become a bigger expense. However, at the beginning, there are options for being cost-effective with your lab space. In many cases, it’s advantageous — even necessary — to start in a shared lab to save on equipment costs. One tip for finding space is to expand your search. For example, even though popular incubator labs like Lab Central in Cambridge, MA may have long waiting lists, there are other nearby options that are cheaper and may be equally as good. A lot of people start leasing commercial space at the Series A stage, but you need to be thinking about how much space you’ll need well ahead of raising money. There’s significant lead time to setting up biotech labs.

Finally, you should budget appropriately for building your IP estate. Especially at the beginning, when you are filing a large number of provisionals, these costs can add up. A good rule of thumb is $10,000 – $15,000 per patent in the U.S. If you file internationally, the cost goes up to $50,000 per patent.

Appendix

If you’re curious, the median amount raised for the companies we surveyed was $10.9M, with the earliest stage company having raised $4.2M and the largest having raised $58M. Here’s the breakdown of the data:

Thanks

Massive thank you to all the founders that took the time to answer our survey and meet with us for more discussion. Thanks to Tony Kulesa, Russ Wilcox, and Sarah Hodges for their feedback.