There’s been a lot of discussion lately about the best path to funding your company. How much is too much? How much is too little? Is it good or bad to have a pre-seed, a seed, a second seed, a pre-A? Is a small round the sign of prudence, capital efficiency and dilution avoidance or an indicator of a lackluster story? There is no single right answer, but I’ll share the following observation:

Successful companies raise a lot of money early in their lives. Many millions.

There are plenty of ways to define success, but in this case, I mean companies worth hundreds of millions or billions of dollars. Our venture capital firm, Pillar, is looking at building companies of meaningful size and scale, so this lens is of particular interest to us.

To test out this thesis, I asked seven Boston-area venture capitalists to give me names of the best dozen companies in our region. They were free to define ‘best’ as they saw fit — revenue, company value, buzz, strength of team, etc. The group of venture capitalists represent a range of interests and investment areas (consumer, enterprise, mobile, infrastructure, etc.).

We took the lists, removed duplications and any companies that only received one vote (to remove “homers”).

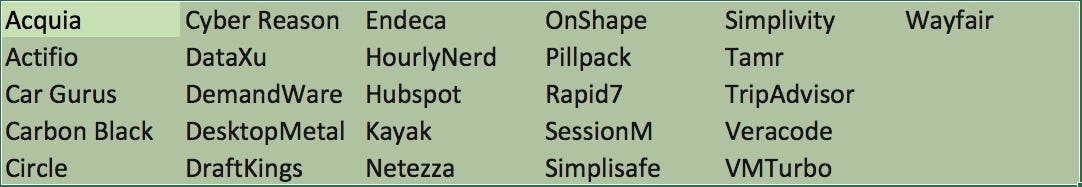

This resulted in a list of 26 companies (alphabetic order).

Using public sources and through conversations with the CEOs, we identified how much capital each of these companies raised within the first 18 months from the day they took their first investment. There’s nothing magical about 18 months, but it felt like long enough for a young company to build momentum. Did they raise a series of small rounds (pre-seed, seed, second seed, post seed) or did they raise more substantial capital — or none at all.

The results:

Two raised no money until they reached substantial scale — Wayfair (started by Niraj Shah and Steve Conine) and Simplisafe. One other, TripAdvisor (started by Steve Kaufer) raised $2M in its first 18 months. Our belief is that all of the rest, 23 of 26 names, raised more than $5M in their first 18 months and the average was $8M.

This admittedly wasn’t the most scientific study — cases could be made for other great companies in the region and funding history for some companies remain confidential — but our approach included a diverse sample of investors and company types across Boston. There are three thoughts as to why this relationship may exist:

- Big valuable ideas require big money or they don’t get started at all.

- The money is a symptom, a proxy for other things — the ability to instill confidence, the ability to sell ideas, to overcome objections and this translates well to execution in business.

- The money is the difference maker — it fuels more product development, more marketing, more partnerships and with all other things being equal enables a company to succeed.

In all cases, there is a clear correlation between raising substantial money early and success.

Mark Suster from Upfront Ventures wrote a very thoughtful article recently cautioning startups about the risks of raising too much money and Eric Paley wrote a great piece about Capital Efficiency that I found very insightful.

What we are talking about now is the other side of the coin.

For some entrepreneurs, raising money is quite easy, but I know many others for whom this isn’t the case. Founders are spending an enormous fraction of their time constantly raising small amounts of money three to six months at a time. Kyle York wrote a piece highlighting this frustration, I’m Tired of this VC Bullshit.

Is this “perpetual fundraising” being driven by angel groups and venture funds that can only write small checks or by entrepreneurs who raise as little as possible in hopes of some magic milestone that will propel their valuation in the next round? Or have entrepreneurs been conditioned to only ask for small amounts? Regardless of cause, the effect is the same. None of our region’s ‘best’ were funded this way.

What would have happened if one of these big successful companies, say HubSpot, had chosen to raise a series of very small rounds rather than $5.5M in their first year? Would they have been as successful in the market? Would they have owned it? Would the founders be better or worse off?

Looking at the list of companies on this chart, I think the founders have probably done quite well or stand to do well if they find liquidity at their current value. Should we wonder if any of them wished they had raised less capital? Or spent more time raising money in smaller atomized bits? It’s just my opinion, but I suspect not.

So are “atomized” seed rounds [a pre-seed, followed by a seed, a seed extension and a pre-A] a viable path to building a company? Perhaps, but our analysis would say it is not the path to building something very valuable. Not to mention that this approach poses an overwhelming distraction to the founders, a focus on very short term goals, and near constant torture.

The other side of the coin to raising too much money, is raising too little, and spending years never…quite…getting…traction.

This is not to suggest that companies need to raise many millions of dollars from day zero. There are many examples of companies who raised modest first rounds and used that capital to flesh out their story, hit some interesting milestones — perhaps concept validation with key customers or even a shipping product — and used these proof points to raise a more substantial second round. For instance, HubSpot raised $500k in seed and then followed less than a year later with $5M. But that’s the point — they raised some initial capital, got traction, and then found investors who believed, who leaned in and helped them ramp to success.

And that, I believe is the point of this analysis. The companies that succeeded were able to find investors who were willing to believe in them and commit to the long term vision. Why were they able to do this? Previous success? Great sales skills? A booming potential market? Novel technology? A combination of all? I’m digging into another post that will look into some of the factors that may have made this possible, but in the meantime, the facts seem to speak for themselves — big ideas require big bets.

Jamie Goldstein

Jamie Goldstein