Home// Articles// Fundraising// Negotiating a Term Sheet — Part 2: Preference / Preferred Stock

Negotiating a Term Sheet — Part 2: Preference / Preferred Stock

Jamie Goldstein

Partner at Pillar

Jamie Goldstein

Partner at Pillar

Just got a term sheet from a VC firm?

Congratulations — that’s no small feat.

In this series, we are looking at the “standard” VC term sheet to understand each of the terms and conditions, why the VC might care and why you should as well.

In this Part 2, we look at Preference / Preferred Stock.

A Preference or Preferred Stock is where an investor buys a security that gives them the right to choose whether to get their money back or convert into common stock.

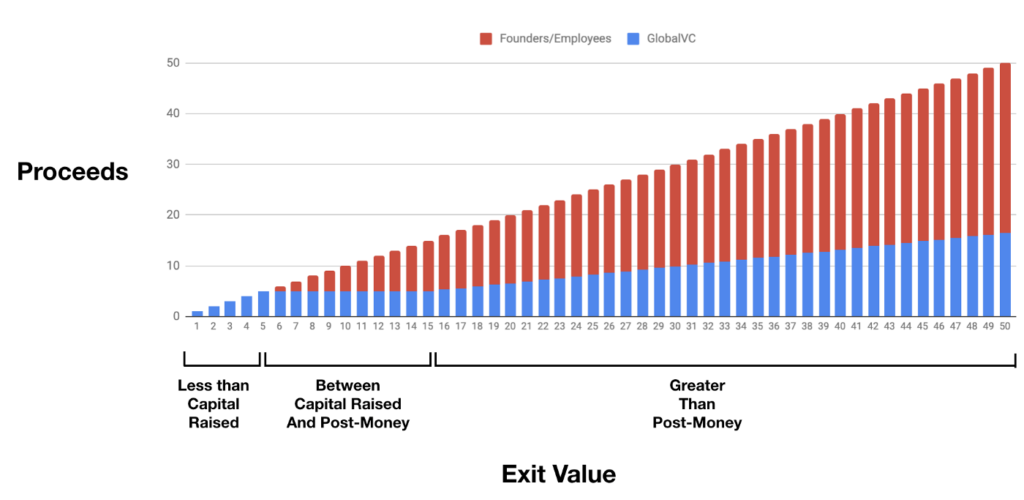

Example: NewCo sells $5M of Preferred Stock at $10M pre-money, $15M post-money to GlobalVC. Global owns 33% of the company, Founders own the other 67%.

But do they really own 33%? It depends on the outcome.

In any exit, Global has a choice, take $5M or 33% of the proceeds. If the company is sold for less than $15M (the post-money valuation), GlobalVC would rather get back their $5M. If the company is sold for more than $15M, GlobalVC would choose 33% of the total.

But what if the company is sold for only $4M, what happens? GlobalVC gets all of it (100%). What if the company is sold for $10M? GlobalVC gets their $5M or 50% of it.

To summarize:

1.

If the outcome is less than the capital raised. Global gets all of it.

2.

If the outcome is more than capital raised, but less than the post-money — Global chooses to take their $5M back, Founders get the remainder.

3.

If the outcome is more than post-money, GlobalVC gets 33%, Founders and employees get 67%.

If Founders raise $20M, $50M or $100M+ they need to exit for more than this amount to see any proceeds.

Furthermore, Founders may think they sold X% of the company (33% in our above example) but that’s only the case if the exit exceeds the post-money of the round. This becomes a bigger factor as post-money valuations in later rounds get large.

Room to Negotiate?

This one is particularly hard.

Preference is somewhat of a safety blanket for investors, especially later-stage investors. If an investor is considering whether to lead a round of $50M at a valuation of $500M, they have to be convinced the company can be worth more than $500M for them to make money, but only need to be convinced that it is worth more than $50M to avoid losing money. Eliminating the preference structure drives these two distinct outcomes ($500M or $50M) to a single price — much like buying a share of IBM in the public markets.

They may be willing to give up the Preference, but a typical mid to late-stage investor would very likely offer a lower pre-money as a result.

Should you consider it?

The downside of a lower pre-money is obviously, more dilution.

The downside of a higher pre-money but with a Preference is a lack of alignment.

I was on the board of a company that raised $50M at $500M valuation and then $100M at $1B. It looked like a certain multi-billion dollar winner. But then, like many companies, it hit some bumps, some big bumps.

The investor who put in the $50M, was no longer dreaming of 5x multiples — this looked like it could be a tough slog. They wanted to cut and run — to get their $50M back and go place a “bet” on the next potential unicorn. As a result, the representative of this firm was calling the CEO weekly and lobbying other Board Members — telling everyone to sell the company for anything greater than $200M (the total capital raised) so he could get his money back. He was completely misaligned with the Founders, not to mention many of the other investors — because of the Preference structure.

It was a huge distraction and could have sunk the company.

[Luckily, the CEO ignored this input, worked hard and turned the company around]

So, yes, while quite rare — you should have the conversation with your investor and should consider taking a mid or late-stage financing with clean terms (ie no Preference) even if it means accepting a lower price. The benefits of alignment could be well worth it.