Home// Articles// Fundraising// Negotiating a Term Sheet — Part 1: Increase to the Option Pool

Negotiating a Term Sheet — Part 1: Increase to the Option Pool

Jamie Goldstein

Partner at Pillar

Jamie Goldstein

Partner at Pillar

Just got a term sheet from a VC firm?

Congratulations — that’s no small feat.

In this series, we are looking at the “standard” VC term sheet to understand each of the terms and conditions, why the VC might care and why you should as well.

In the Part 1, we look at an Increase to Option Pool.

In a typical term sheet, the investor will specify an option pool — a bucket of stock options for future employees. Having an agreed on pool makes life easier for everyone — you don’t have to get shareholder consent every time you want to make a new hire and the VC doesn’t see their ownership get diluted by every hire either.

Typically the term sheet will say that the shares needed for this new option pool are included in the pre-money valuation. How come?

Let’s look at the math:

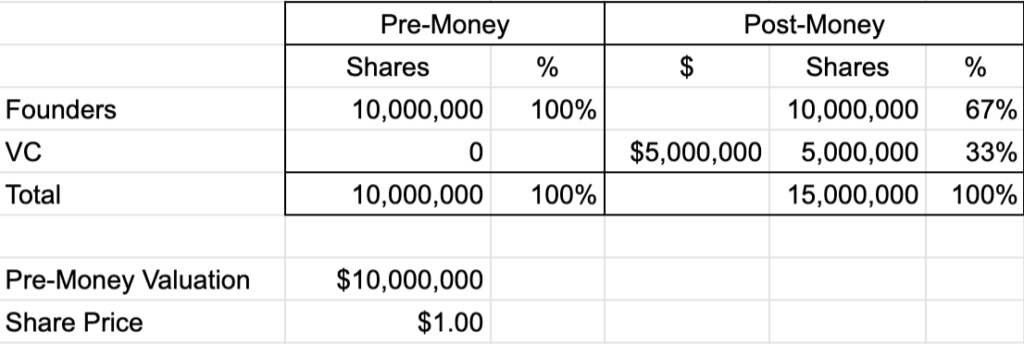

The VC decides to invest $5M for 33% of your company. This translates to a $10M pre-money valuation, $15M post-money valuation. Assuming there were 10,000,000 shares outstanding when the Founders started the company, the capitalization table would look like:

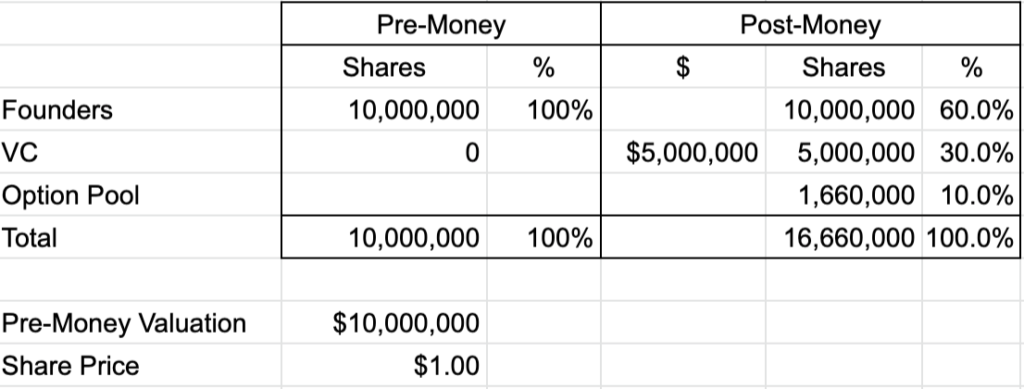

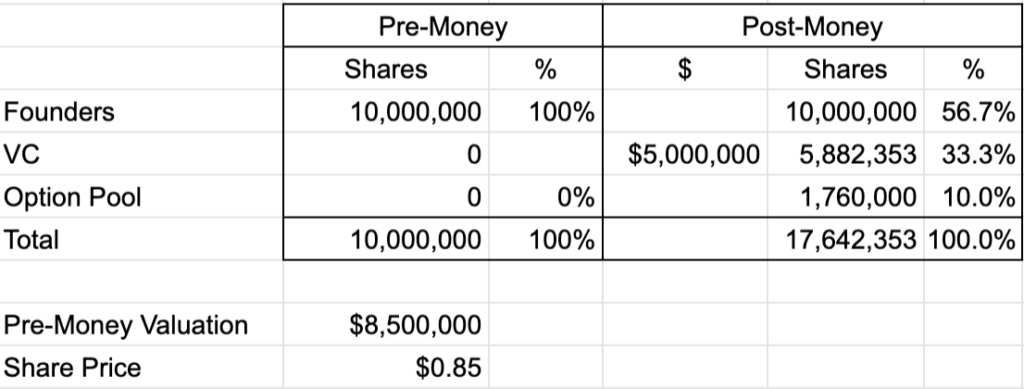

The VC believes and you agree (hypothetically) that 10% will be needed for future hires — so a pool is created the week after the financing. Now the cap table looks like:

But now the VC didn’t buy 33%, they purchased 30%. The creation of the option pool diluted all shareholders — including the VC. Now the effective pre-money of their investment doesn’t look like $10M, it looks like $11.6M (calculated as $5M/30% less the $5M investment.

On the other hand, the pre-money valuation of what the Founders own was indeed $10M (calculated as the share price of $1 * the shares they own 10M)

VCs don’t like this.

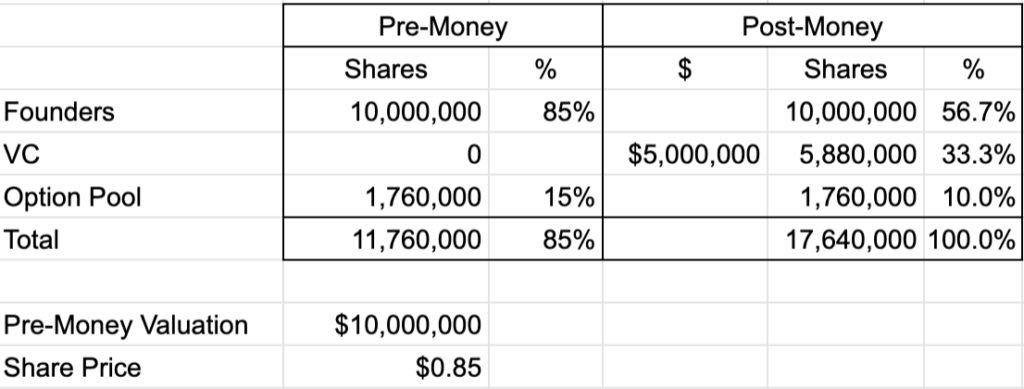

They want their 33% and expect to own that amount (roughly) until the next financing. Therefore they typically propose that the option pool is part of the pre-money valuation. The cap table:

Now the VC’s $5M did indeed buy 33% but the Founder’s share is down to 56%. What happened?

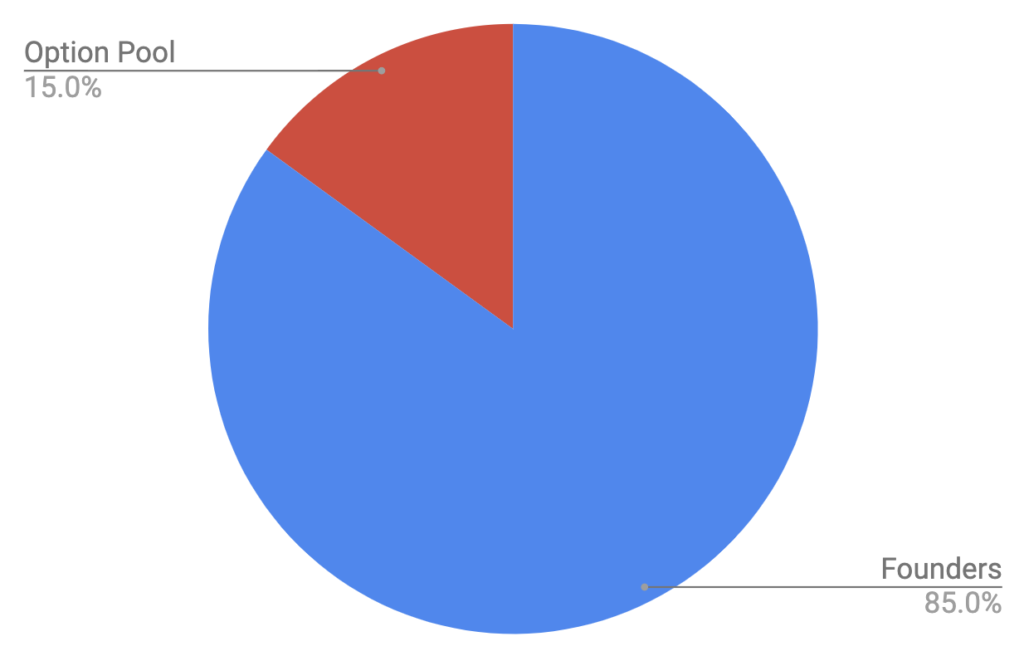

The pre-money capitalization, now 11.7M shares, is comprised of 10M shares owned by the Founders and 1.76M new options in the pool. Only 85% of this pre-money is owned by the Founders (15% by the pool). The $10M is the value placed on the sum of these.

The same exact math can be realized by lowering the pre-money to $8.5M and adding the pool at the end

Room to Negotiate?

Yes. There are two factors — how big the pool needs to be, and who should pay for it. I would encourage you to separate those two discussions.

First, the Pool Size. Your financing plan likely showed a budget for how you’ll spend the money and how long it will last — perhaps 18 months. What hires need to be made in that time frame and how much equity will each of those hires require? For instance, a Director of Product Management might require 0.75%. Sum all of these hires and that should be the amount available in the pool. Maybe multiply by 1.1 to give yourself a little cushion.

This is a good opportunity to get in sync with your VC — what roles the Founders will hold, what key people need to be brought in, what will we be looking for in those people? Where should we hire our engineering team and what equity is required for those individuals? If your VC is looking for a far bigger pool than you think is required, it could be that they are trying to pad the pool or it could be that they have different expectations for how the organization will look (eg — they want to bring on a CEO). Gulp.

You may be tempted to try to low ball the numbers in this conversation — my belief is that if you do, you are just asking for trouble later. If you run out of pool far sooner than planned, your new VC “partner” may not be very happy.

Second, who pays for it? Once you have agreement on the size of the pool, now the question of who pays. It is really just math.

An investment of:

$5M at $10M with the

10% pool in the pre-money

=

$5M at $8.5M with the

10% pool added post-money

The pool size, whether it is created pre or post, and pre-money valuation are all tied together.

But here’s where you might be able to work the system in your favor. A VC fund is likely to produce reports for their limited partners that show pre-money valuations (entry price of their investments), but they are very unlikely to show the size of the pool at the time of the investment.

They might prefer to show a lower pre-money entry price (makes them look like disciplined investors) and create some or all of the pool post-money. In giving on a lower valuation and pushing some (or all) of the pool to later, you might be able to squeak out some slightly better economics overall. Your ego might be a bit bruised but your ownership will be better for it!

Good luck.